Life Insurance in and around San Francisco

Insurance that helps life's moments move on

What are you waiting for?

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

No one likes to think about death. But taking the time now to secure a life insurance policy with State Farm is a way to demonstrate love to the people you're closest to if death comes.

Insurance that helps life's moments move on

What are you waiting for?

San Francisco Chooses Life Insurance From State Farm

The beneficiary designated in your Life insurance policy can help cover certain expenses for the people you're closest to when you pass away. The death benefit can help with things such as future savings, childcare costs or phone bills. With State Farm, you can rely on us to be there when it's needed most, while also providing understanding, responsible service.

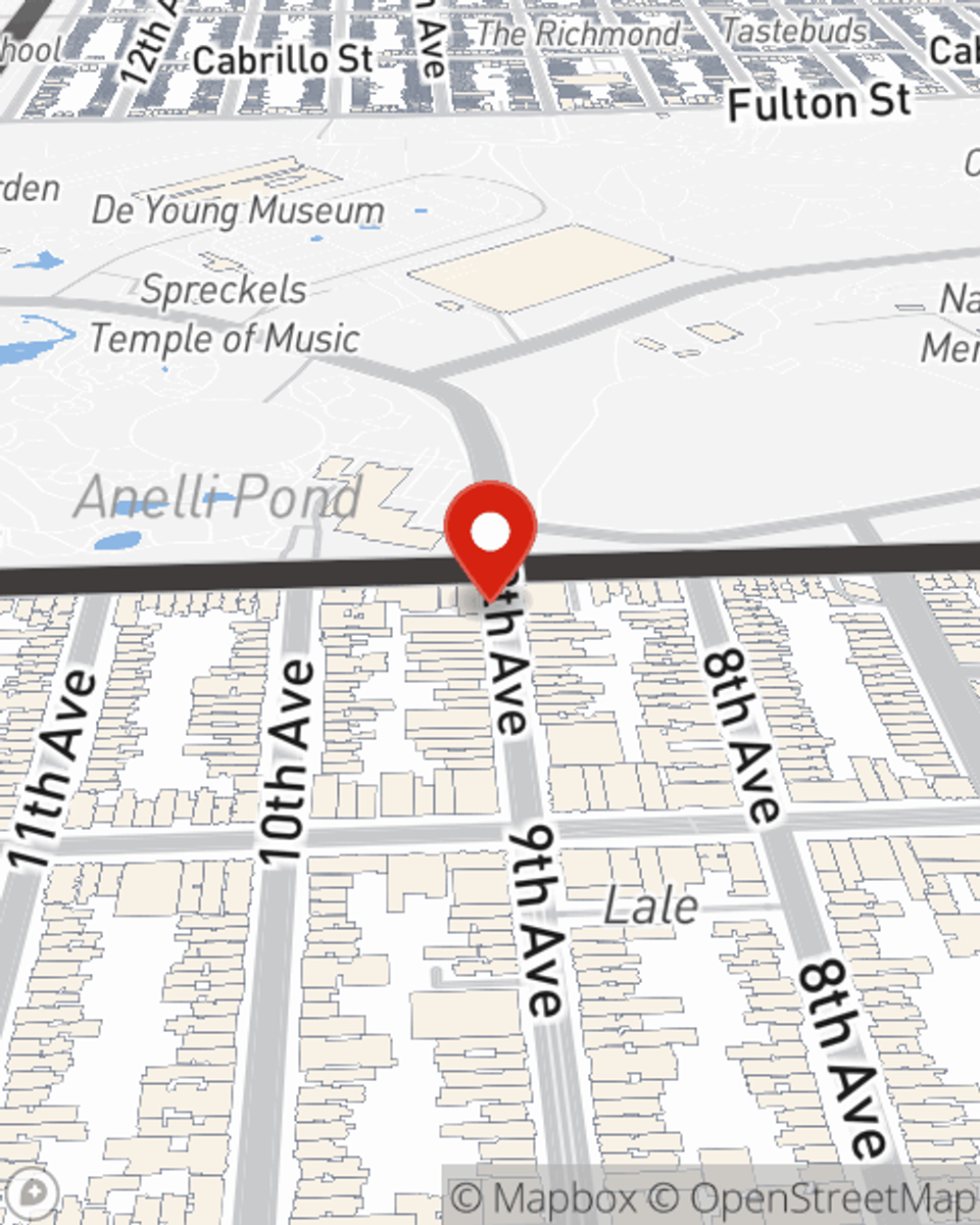

With responsible, compassionate service, State Farm agent Christie Kennett can help you make sure you and your loved ones have coverage if something bad does happen. Call or email Christie Kennett's office today to get started on the options that are right for you.

Have More Questions About Life Insurance?

Call Christie at (415) 661-3651 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Christie Kennett

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.